Governance Assurance & Capital Stewardship

Gold Outlook and Hedging Considerations (May–July 2025)

Introduction to Hedging

In volatile commodity markets like gold, hedging is a widely used strategy to protect against price movements that could impact profitability. Whether through futures contracts, options, or structured products, hedging allows miners, investors, and institutions to lock in current prices or mitigate downside risk, while still participating in upside potential. In an environment characterised by uncertainty—both technical and fundamental—effective hedging can provide stability and strategic advantage.

Current Market Snapshot

Gold continues to demonstrate strong fundamental appeal, underpinned by a solid uptrend and a host of supportive macro drivers. However, recent technical patterns suggest the market may be due for a breather in the short term. A measured approach to risk management, including considering hedging strategies, would be prudent over the coming months.

Potential outlook for gold over the next 2-3 months (approximately May-July 2025), considering the technical picture from the chart and the fundamental drivers from recent analysis.

1. Technical Analysis (Based on the chart):

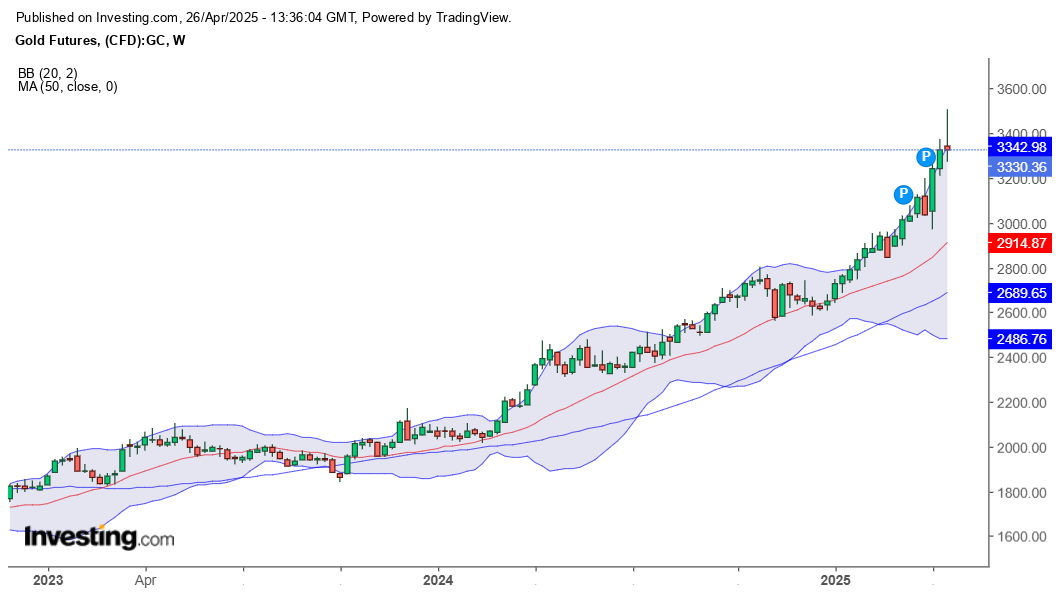

- Strong Uptrend: The weekly chart clearly shows a powerful uptrend in Gold Futures (GC). Prices are significantly above the 50-week moving average and have been riding the upper Bollinger Band, indicating strong bullish momentum.

- Potential Topping Signal: The "pin bar" (or shooting star) candlestick pattern for the last week is quite strong. This pattern, characterized by a long upper wick and a small real body closing near the low of the session, occurring after a strong rally and near the upper Bollinger Band, does indeed suggest potential buyer exhaustion and that sellers stepped in at the highs. This can be a sign of a short-term top or the beginning of a consolidation phase.

- Overbought Condition: Trading consistently near the upper Bollinger Band often indicates a market that is potentially overbought in the short term, increasing the chances of a pause or pullback.

2. Fundamental Drivers & Recent Context:

- Geopolitics & Tariffs: This remains a key driver. Gold recently surged to a record near $3,500/oz, partly driven by President Trump's announcement of a 10% tariff on all US imports, increasing safe-haven demand. A subsequent softening in tone led to a pullback. Ongoing geopolitical tensions (US-China, Russia-Ukraine, Middle East) and general global uncertainty continue to provide underlying support for gold.

- US Dollar: The Dollar Index (DXY) has weakened recently after a period of strength, which supported gold's rise. Forecasts are mixed; some expect further weakness supporting gold, while others see potential for the dollar to strengthen again, perhaps linked to tariff impacts or relative economic strength, which could be a headwind for gold.

- Interest Rates (Fed Policy): The Federal Reserve held interest rates steady at 4.5% in March 2025, pausing after rate cuts that started in late 2024. While they project slightly higher inflation (partly due to tariffs), the market generally still anticipates gradual rate cuts later in 2025. Lower interest rates decrease the opportunity cost of holding non-yielding gold and are typically bullish for the metal. However, the Fed is currently adopting a "wait-and-see" approach regarding the impact of tariffs.

- Central Bank Buying: This is a powerful bullish factor. Central banks globally, particularly in emerging markets like China, India, Poland, and Turkey, have been buying gold consistently and significantly to diversify reserves away from the US dollar and hedge against instability. This trend accelerated in 2025 and provides strong underlying support for the price. The Reserve Bank of India, for instance, added a significant 57.5 tonnes in FY25.

- ETF Flows: After lagging in previous years, Gold ETF inflows have become strongly positive in 2025, especially accelerating in recent weeks as prices broke key levels ($3,000, $3,500). This renewed investor interest, particularly from the US and China, adds another layer of demand. Total holdings are high but still below 2020 peaks, suggesting potential for further inflows.

3. Analyst Outlook & Price Targets:

- Generally Bullish Long-Term: Many major institutions (Goldman Sachs, Citi, JP Morgan) remain bullish, citing central bank demand, geopolitical risks, and eventual rate cuts. Some forecasts see gold potentially reaching $4,000 or higher by late 2025 or mid-2026.

- Short-Term Caution: Some technical analysts point to the overbought conditions and recent price action (like the pin bar) suggesting a potential for a pullback or consolidation in the near term. One analyst suggested a possible retest of the $2,800 level by May/June.

Overall Outlook for Next 2-3 Months (May-July 2025):

Considering the technically overbought condition and the pin bar signal after a very sharp rally, juxtaposed with strong underlying fundamental support, the most likely scenario for the next 2-3 months involves:

- Consolidation/Pullback Phase: The pin bar suggests a high probability of a pause in the strong uptrend. Gold might consolidate sideways or experience a pullback in the near term (potentially May). Support levels to watch could be around the recent lows near $3,300, the psychological $3,000-$3,200 area, or potentially lower towards $2,950/$2,800 in a more significant correction.

- Resumption of Uptrend: Given the strength of the fundamental drivers (especially relentless central bank buying and persistent geopolitical risks), any pullback is likely to be viewed by many as a buying opportunity. Following a period of consolidation, the uptrend has a good chance of resuming later within the 2-3 month window, potentially re-challenging the recent highs near $3,500 or pushing higher, especially if expectations for Fed rate cuts later in the year solidify or geopolitical tensions flare up again.

In summary: While the long-term picture looks bullish, the technical signals from the chart suggest a period of digestion or correction is likely in the immediate future (next few weeks to a month). However, the strong fundamental support should limit the downside and likely lead to a resumption of the uptrend within the 2-3 month timeframe.

Disclaimer: Market forecasting is inherently uncertain. This analysis is based on current information and chart patterns, but unexpected events or shifts in market sentiment could alter the outcome.

Categories

Tags

Recent Posts